maricopa county irs tax liens

Tiarra Earls Haas Communications Officer Maricopa County AZ. If you read the news about tax lien sales in the Empire State you know New York City is having issues moving forward with a tax sale.

Fillable Form 1040x 2017 Lesson Health Care Coverage Tax Forms

AND IRS Form W-9 IRS Form W-8BEN for Foreign Individuals or IRS Form W-8BEN-E for Foreign Entities.

. In fact IRS liens priority is based on the order recorded. The Tax Lien Sale will be held on February 9 2021. In fact the rate of return on property tax liens investments in.

Ad Search Information On Liens Possible Owners Location Estimated Value Comps More. Welcome to the Maricopa County Treasurers IRS Forms Page. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate.

Maricopa County AZ currently has 18180 tax liens available as of June 8. W-8BEN - Certificate of Foreign Status of Beneficial Owner. Maricopa Coconino and Pinal County for example hold online auctions whereas Pima Santa Cruz and Cochise.

Ad Find The Best Deals In Your Area Free Course Shows How. What do you mean the tax lien was the result of an internal auditdoesnt make sensewhat you may mean is that IRS either caught you up in 1099-B matching or you didnt. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Each county handles the auction process differently.

Search Any Address 2. The Segment 1 video for the federal tax lien discharge and subordination process introduces the. For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at.

Arizona Department of Revenue. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. The interest rate paid to the county on delinquent taxes is 16.

Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide. 2 Maximum interest rate is 16. Instructions and forms for filing an out-of-state or foreign judgment are available on the Clerks Forms page.

There is 1 IRS Office per. The Arizona Tax Department was established in September 1988 and has jurisdiction over disputes anywhere in the state that involves the imposition assessment or. There are 3 IRS Offices in Maricopa County Arizona serving a population of 4155501 people in an area of 9198 square miles.

Government Property Lease Excise Tax. You will also need a Civil Cover Sheet. See Available Property Records Liens Owner Info More.

1 Parcels may be advertised but not auctioned because of pending litigation such as bankruptcy. Check your Arizona tax liens. When a lien is auctioned it is possible for the bidder to.

Recording the judgment at the County Recorders office. You must complete and submit IRS form W-8BEN-E instead of IRS form W. Ad Check How to Qualify for the Child Tax Relief Program with Our Guide.

Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Ad Use our tax forgiveness calculator to estimate potential relief available.

The instructions and forms are also. 602-506-8511 or the Clerk of the Boards Office at. 27 rows Tax Lien Statistics - as of 4252022.

Maricopa County Treasurers Home Page. This page provides links to the IRS Tax Forms. Just remember each state has its own bidding process.

The Maricopa County Treasurers Office is to provide billing collection investment and. Maricopa County Treasurer Attention Tax Lien Department 301 W. Applying to the IRS for a Lien Discharge or Subordination.

Delinquent and Unsold Parcels. Pursuant to ARS 42-18106 a listing of each parcel showing the parcel number delinquent tax amount. The place date and time of the tax lien sale.

Jefferson St Suite 140 Phoenix AZ. Investors are permitted to bid on each tax lien via auction held. Tax lien certificates are sold to investors to recover the delinquent property taxes owed by the property owner.

Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St. For SaleFor Lease Sign ARS 33-1808Condo ARS 33. The IRS requires us to withhold a percentage of in the proceeds for non-compliance.

The rest of the state is not having those problems.

An Interview With The Maricopa County Treasurer Asreb

Tax Debt Collection Compromise Levy Liens Lawyers Silver Law Plc

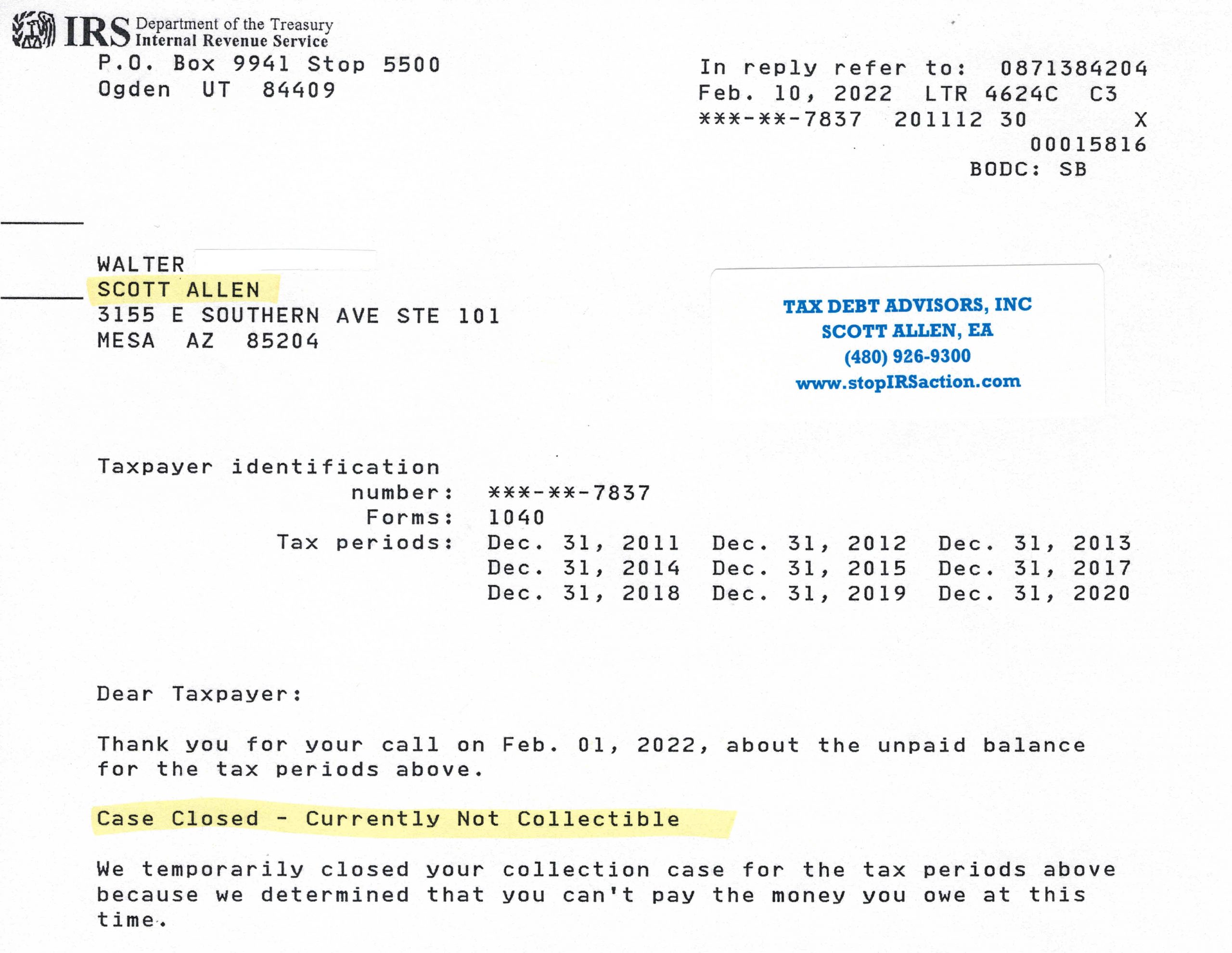

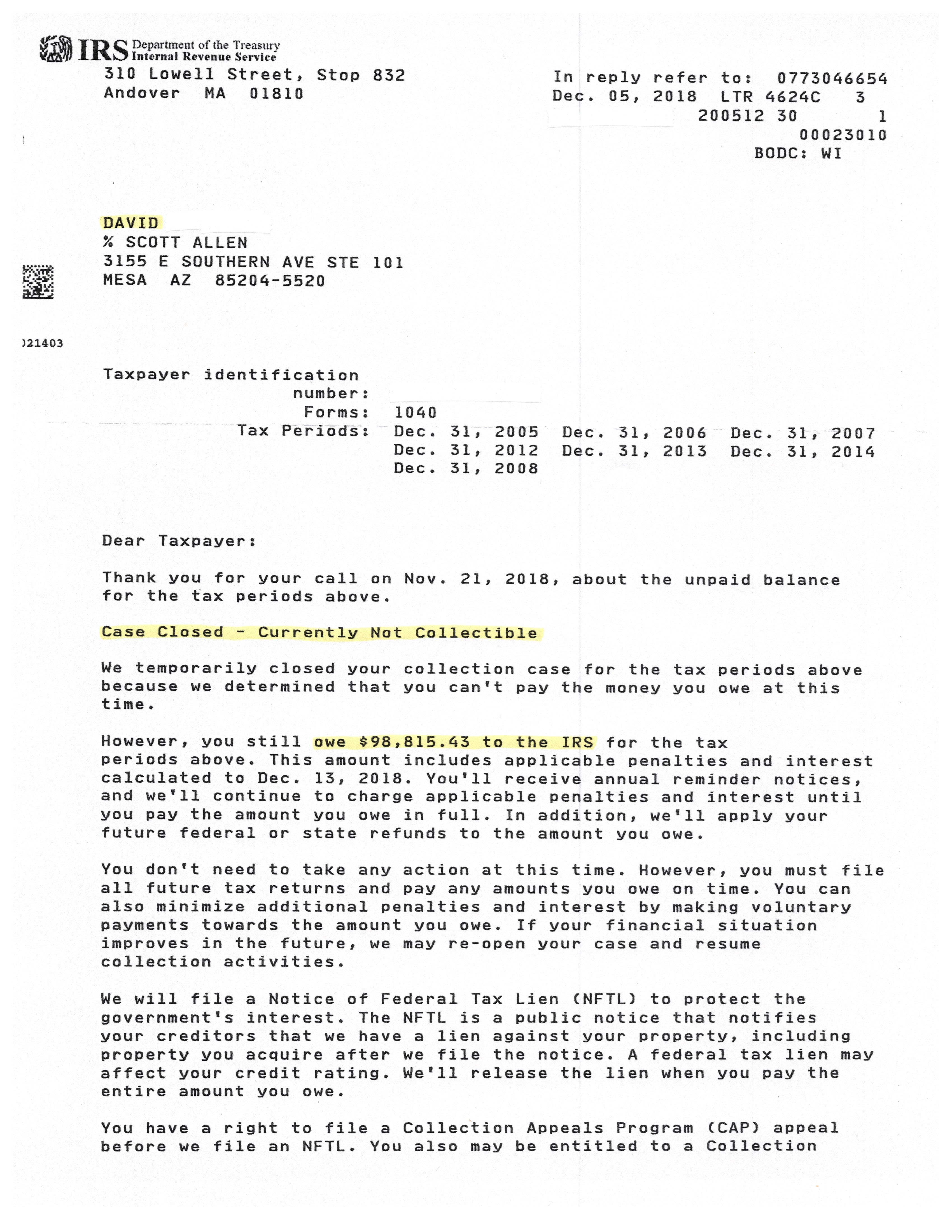

Irs Tax Lien Problems Tax Debt Advisors

What You Need To Know About The Arizona Tax Lien Sales Tax Lien Investing Tips

Maricopa County Treasurer S Office John M Allen Treasurer

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Irs Tax Lien Problems Tax Debt Advisors

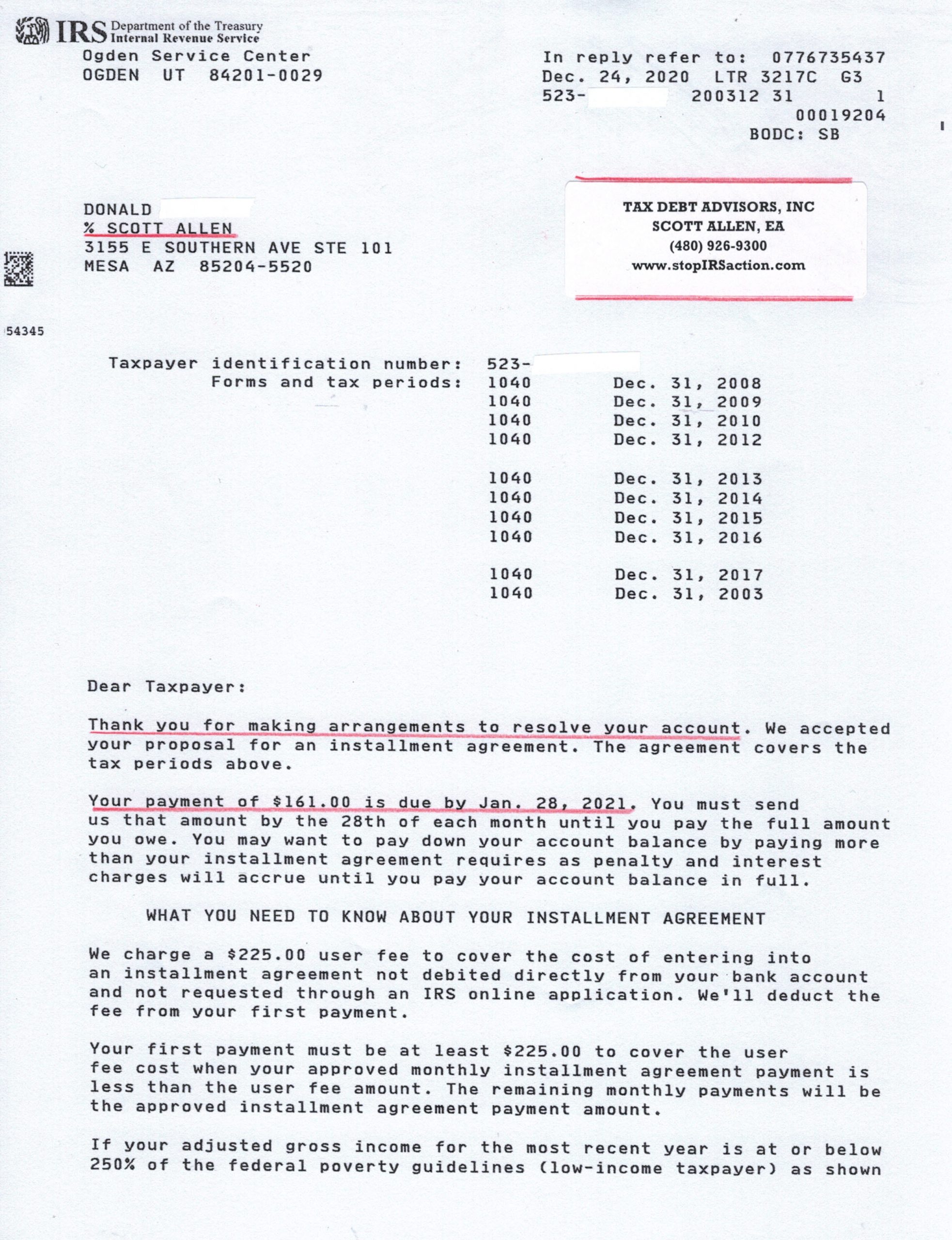

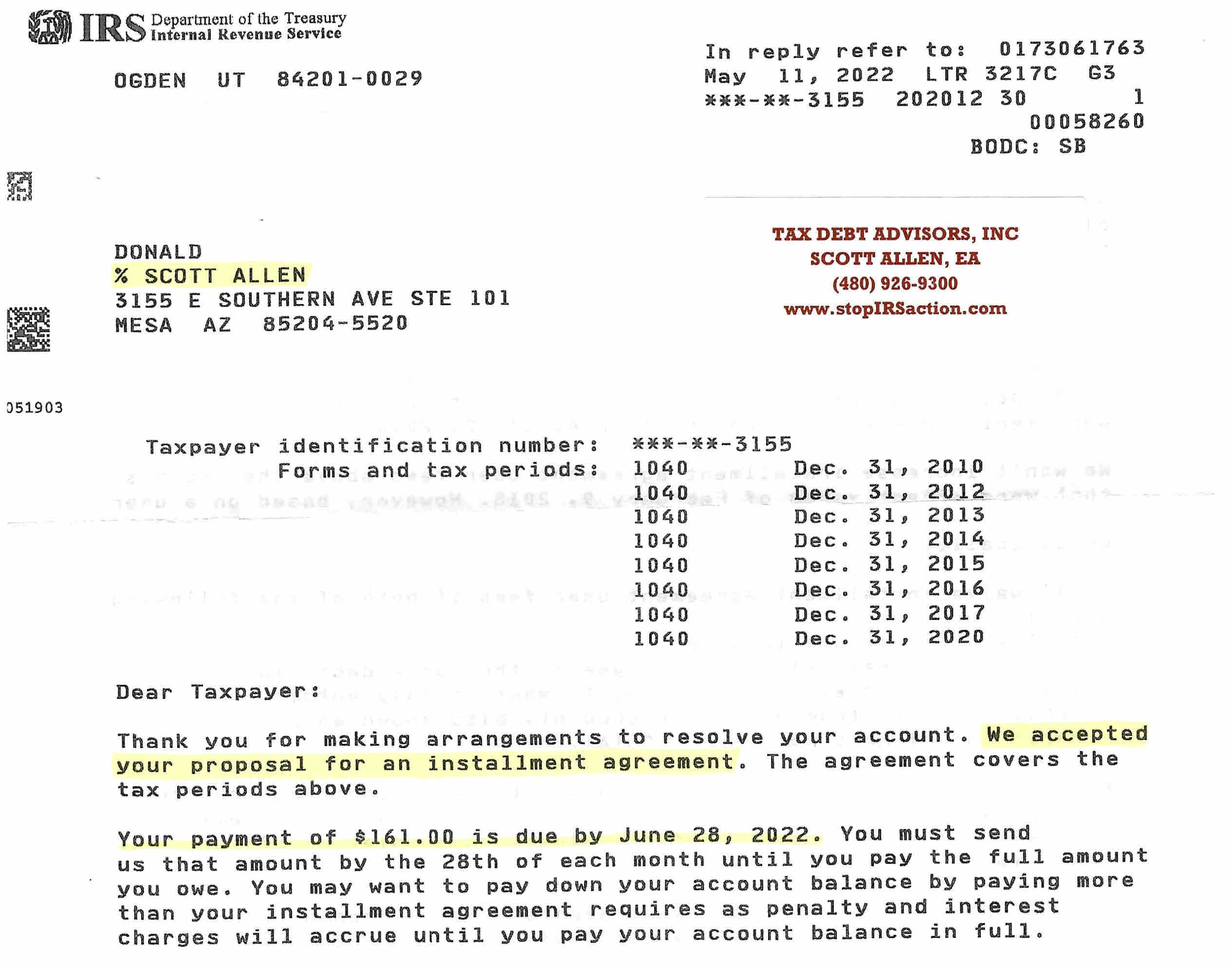

Irs Tax Payment Plan Tax Debt Advisors

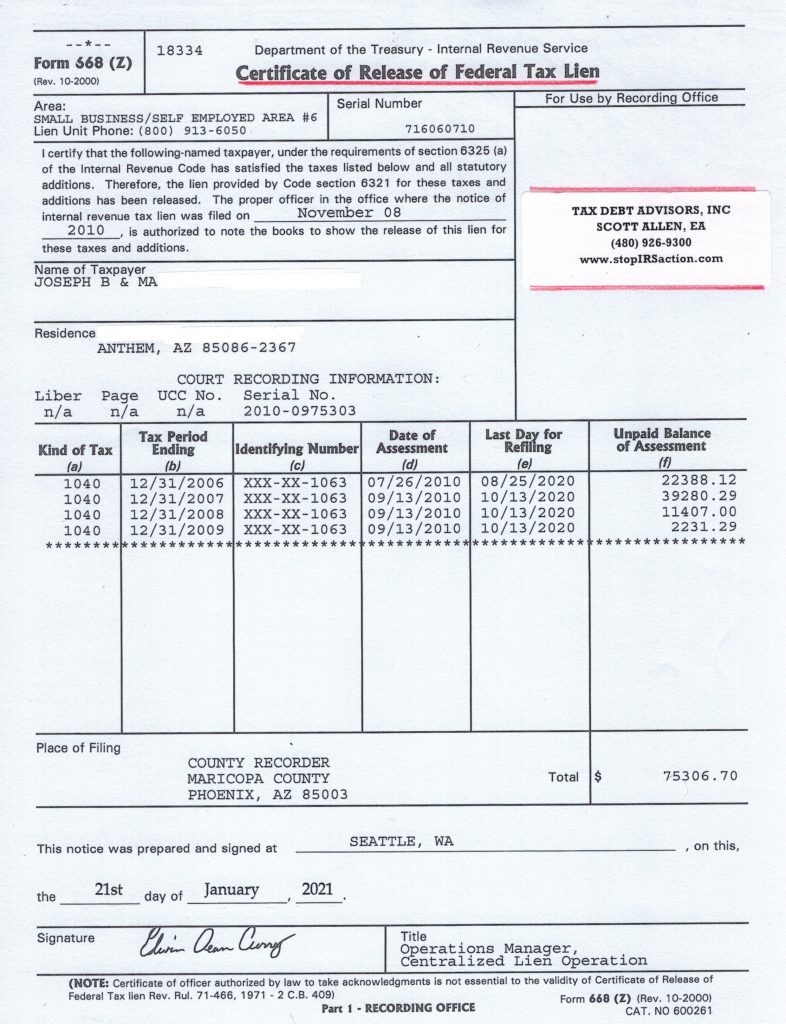

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

An Interview With The Maricopa County Treasurer Asreb

The Basics Of Tax Liens Arizona School Of Real Estate And Business

Foreclosure Of Association S Assessment Lien And Tax Liens Hoa Lawyer

How To Buy Real Estate Tax Liens And Earn Up To 36 Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers